Understanding Risk – What does risk mean to you?

When advising on investing, one of the first things I do with all my clients is ask a series of questions to help me understand the extent to which they are prepared to take risks with their money, their ability to manage with any losses that may occur and the need to take risk to help them achieve their investment goals.

This ‘risk profiling’ is an essential part of my work with clients, both existing and new. The better I understand your attitude to risk and how you feel about the potential ups and downs your investment may experience, the better able I am to recommend a suitable investment plan for you.

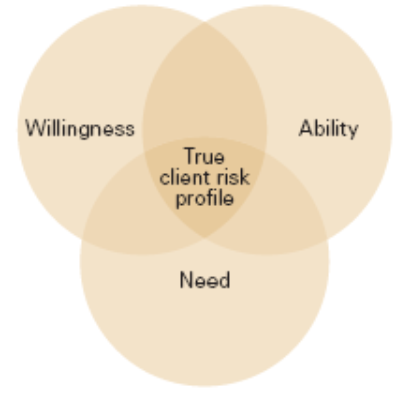

Component of a risk profile

There are three key components to your true risk profile, which are:

Ability to take risk relates to financial circumstances and investment goals. Generally speaking, the higher the level of wealth relative to liabilities, and the longer the investment horizon, then the greater the ability to take risk.

Willingness, or ‘risk attitude’, on the other hand, relates to psychology, rather than to financial circumstances. Some individuals find the prospect of investment volatility – ups and downs in values – and the chance of losses distressing. Others are more relaxed about those issues.

The need to take risk is the third component of a true client risk profile. Willingness and ability need to be assessed in the context of your need to take risk to achieve a goal. If you have a very low risk profile with a very demanding investment objective, something will have to give.

Understanding your risk profile

Your personal risk profile shows how ready you are to potentially lose money in return for the prospect of future rewards. Your profile depends on your attitude to risk and your reasons for investing. It also depends on your financial situation and how far into the future is your investment horizon.

Your attitude to risk

If you have a high risk tolerance, you may be more willing to have riskier and more aggressive investments in your portfolio, such as shares or property, in the hope of making potentially higher investment returns. If you are more cautious, you may want to focus on preserving your original capital as much as possible and prefer more stable and low-risk investments, such as fixed-interest bonds or cash, even though these are likely to offer more modest investment returns.

Capacity for loss

What your attitude to risk can’t tell you is your capacity for loss. Although separate from your risk profile, your capacity for loss is an important part of my conversation with you relating to investments. In short, your capacity for loss is your ability to absorb falls in the value of your investments and any income that may come from them.

Selecting the right investment solution for your financial objectives and financial circumstances comes from a combined result of your risk profile and your capacity for loss. Only by considering the two side-by-side will a suitable investment be possible.

For example, if you were investing to provide an income, any fall in value of the investment could have a significant impact on your financial circumstances and might lead you to struggle financially. Then whilst you may have a high willingness to take investment risk, it would be prudent to ensure that any investment solution was more focussed on protecting your investment.

Your risk profile over time

Your risk tolerance and capacity for loss will change over time. Investors in their 20s may not be too worried about a big drop in markets, reasoning they have time to ride it out and profit in a later recovery. Investors in their 70s on the other hand, may focus more on protecting against loss of wealth.

The importance of setting objectives

Before deciding on which investments to use, it is important to evaluate why you are investing and how long you are going to leave the money invested. Balancing the risk you are willing to accept with the investment returns you need to meet your investment objectives will help determine which investments to choose.

Different time-frame – different approach

Deciding on the basic structure of your investment portfolio is called asset allocation. If you are investing for a long term goal such as for retirement, you might choose to hold some share-based assets. On the other hand, if you are investing for a short term goal, such as a wedding, you may decide to hold more cash.

Different objectives – different approach

Deciding your investment objective will determine what type of portfolio you require. Younger investors, or those with a higher tolerance for risk, might seek a more aggressive investment strategy. This type of portfolio will hold a higher proportion of shares as they may deliver greater returns over the long term, but involves a higher level of risk. Older investors, or those with a lower risk tolerance, might seek a portfolio that preserves capital. This can be done by holding a greater proportion of cash and fixed-interest bonds. Lower risk portfolios often have the ability to pay a certain level of income.

Managing risk

Managing risk is a key objective for all investments, and four of the main strategies used are explained below.

Different risk types

Investors face many risks. Some are general and some are related to particular kinds of investments, however each must be considered when constructing your investment plan.

The following are the key types of risks to consider when investing.

Inflation risks

Inflation is like a stealth tax eating away at the value of money. You won’t see a smaller cash balance in your account, but the amount that you can purchase with each pound in that account slowly erodes over time. Many savings accounts fail to pay a return that beats inflation, especially after tax is deducted. So even if you reinvest every penny of your interest, the real value of your savings could fall.

Shortfall risk

This means the risk of failing to meet your long-term investment target. For example, if you are saving for your retirement, putting all your money into a savings account may not build enough capital to produce the income you will need in retirement. On the other hand, you could also be exposed to shortfall risk if you invest in too many high risk assets causing your portfolio to lose value at the wrong time. So investing too aggressively or too conservatively can each lead to shortfall risk.

Broad market risk

Individual markets, whether shares, fixed-interest bonds, property or even cash, are exposed to a variety of factors that can lead whole markets, or even most markets, to decline together. We have seen this throughout the majority of this century, most markedly during the 2007/8 global financial crisis.

These are the major risks involved with investing, but it is by no means a complete list. Specific investments may come with other risks not mentioned, but I will always discuss these with you before you invest.

What next?

If you have money to invest or have already invested, but are unsure of the suitability of those investments, let’s start a discussion. Please fill-in the form below and I’ll give you a link to our risk-profiling tool to start off a review process.

-

-

-

0800 074 8755info@clivebarwell.co.uk